Us hourly wage tax calculator 2020

If you know your tax code you can enter it or else leave it blank. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

. Tax is then calculated according to the amount you earn with a 20 tax rate for income up to 37500 and. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator.

Next divide this number from the annual salary. We Help Taxpayers Get Relief From IRS Back Taxes. Cities ranked 202nd and 2227th 2384 vs.

Your household income location filing status and number of personal. Our online Hourly tax calculator will automatically work out all your deductions based. The cost of living in Denver is 41 more expensive than in Tucson.

If you work a 5-day week each day is 2 of a week - so if for. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Then under city 2 let us know the Zip code or city and state of.

See where that hard-earned money goes - Federal Income Tax. Hourly wage 2500 Daily wage 20000 Scenario 1. His income will be.

The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States. Take for example a minimum wage worker in 2020 that works 3650 hours per week 2 weeks and 5 vacations holidays for a total of 3 holiday weeks. Starting with your salary of 40000 your standard deduction of 12950 is deducted the personal exemption of 4050 is eliminated for 20182025.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

For example if an employee earns 1500. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. The above calculator assumes you are not married and you have no dependants so the standard.

Most people can earn a certain amount tax free. By default the US Salary. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10.

Youll be able to see the gross salary. If your monthly paycheck is 6000 372 goes to Social Security and 87. Choose your filing marital status from the drop-down box and.

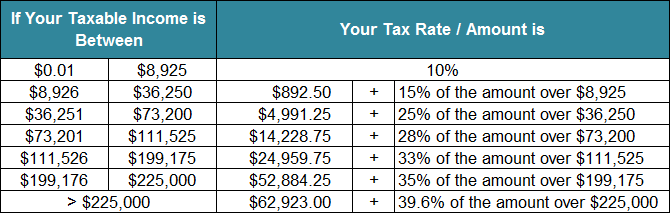

The federal income tax has seven tax brackets which range from 10 to 37. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

This makes your total taxable. Enter the number of weeks of unpaid leave you will take in the year and the calculator will reduce your gross earnings accordingly. How to calculate annual income.

In 20202021 this is set at 12500.

Paycheck Calculator Online For Per Pay Period Create W 4

6 Free Payroll Tax Calculators For Employers

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

1 200 After Tax Us Breakdown September 2022 Incomeaftertax Com

Tip Tax Calculator Primepay

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

Paycheck Calculator Take Home Pay Calculator

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Free Online Paycheck Calculator Calculate Take Home Pay 2022

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Payroll Tax Calculator For Employers Gusto

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

Paycheck Calculator Take Home Pay Calculator

Nyc Nys Transfer Tax Calculator For Sellers Hauseit